Plentina Loan App Review

«Plentina» - Loan company summary:

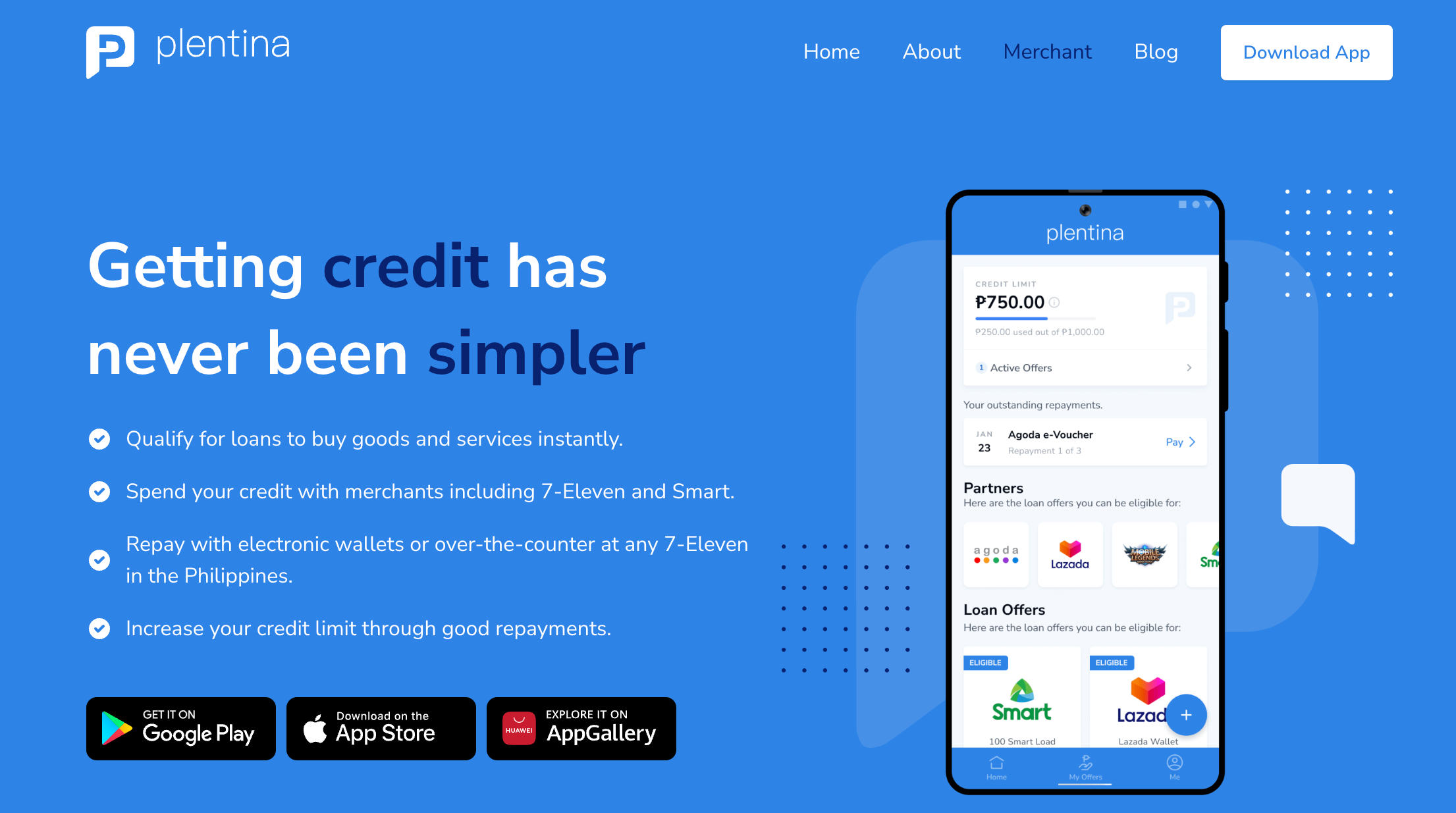

The Plentina Loan App is revolutionizing the way individuals access financial services, providing quick and easy loan solutions directly from their smartphones. This guide covers everything you need to know about the Plentina Loan App, from registration to making payments and managing your loan effectively.

What is the Plentina Loan App?

Plentina Loan App offers a convenient platform for users to apply for and manage short-term loans. Designed to help users meet their immediate financial needs, the app provides a seamless experience, with quick approval processes and transparent terms.

Key Features

- Quick Loan Approvals: fast processing times from application to disbursement.

- Flexible Repayment Terms: options to choose repayment plans that suit individual financial situations.

- User-Friendly Interface: easy navigation and intuitive design make managing loans straightforward.

Registration Process

Step-by-Step Guide:

- Download the App: available on both Android and iOS, download the app from the respective app store.

- Create an Account: enter your personal information such as name, email address, and contact details.

- Verify Your Identity: upload required documents such as a government-issued ID for KYC (Know Your Customer) purposes.

- Set Up Payment Options: link your bank account or preferred payment methods for loan disbursement and repayments.

Applying for a Loan

How to Apply:

- Log In to Your Account: access your account through the app.

- Fill Out the Loan Application: provide necessary financial details and the amount you wish to borrow.

- Submit the Application: review your information and submit the application.

- Wait for Approval: loan approvals can be as quick as a few hours depending on the verification process.

Making Payments

Payment Options:

- Direct Bank Transfer: send payments directly from your bank account to Plentina.

- Mobile Payment Options: use popular mobile payment systems integrated within the app.

- Automatic Repayment Setup: opt for automatic deductions on due dates to avoid late fees.

Tips for Timely Payments:

- Set Reminders: use the app’s reminder system to keep track of payment due dates.

- Check Balances Regularly: stay informed about your loan balance and upcoming payments within the app.

Managing Your Loan

Useful Features:

- Loan Calculator: use the in-app calculator to understand potential interest rates and repayment amounts.

- Customer Support: access 24/7 customer support for any inquiries or issues regarding your loan.

- Loan Adjustment: request changes to your loan terms if your financial situation changes.

What are the Pros and Cons of Using the Plentina Loan App?

Before deciding to use the Plentina loan app, it’s important to consider its pros and cons to determine if it suits your financial needs.

Pros of Using the Plentina Loan App

Here are several benefits that make the Plentina loan app a convenient financing option:

- Handles Unexpected Expenses: Whether you need to shop for groceries before payday or face an unforeseen expense, Plentina provides a quick financial solution.

- Comprehensive Mobile App: The Plentina app is versatile, allowing users to obtain loans, make payments, and manage repayments all via their smartphone.

- Quick and Easy Loan Approval: Plentina boasts a streamlined process that can approve loans in as little as five minutes.

- Wide Acceptance: Use Plentina at various major retailers both online and in-store, including popular places like Puregold, National Book Store, and Lazada.

Cons of Using the Plentina Loan App

However, there are also drawbacks to consider before applying for a loan with Plentina:

- Limited Loan Amounts: The loan amounts offered by Plentina are relatively small, which might not be suitable for larger investments.

- Service Fees: Using Plentina’s financing options incurs service fees, which increase with longer repayment terms.

- Restricted Use at Partner Merchants: The loans can only be used at Plentina’s partner merchants, limiting where you can shop.

- Potential for Impulse Buying: As with many buy-now-pay-later platforms, the ease of obtaining credit can lead to impulse purchases that might not otherwise be made.

Evaluating these advantages and disadvantages will help you make an informed decision about whether the Plentina loan app is the right choice for your financial circumstances.

Plentina Loan App is a powerful tool for managing short-term financial needs effectively. With its easy registration process, flexible repayment options, and comprehensive management features, Plentina offers a modern solution for today’s financial challenges. Make sure to use the app responsibly to maximize its benefits and maintain financial health.

On the partner site