OLP Loan App Review

«OLP» - Loan company summary:

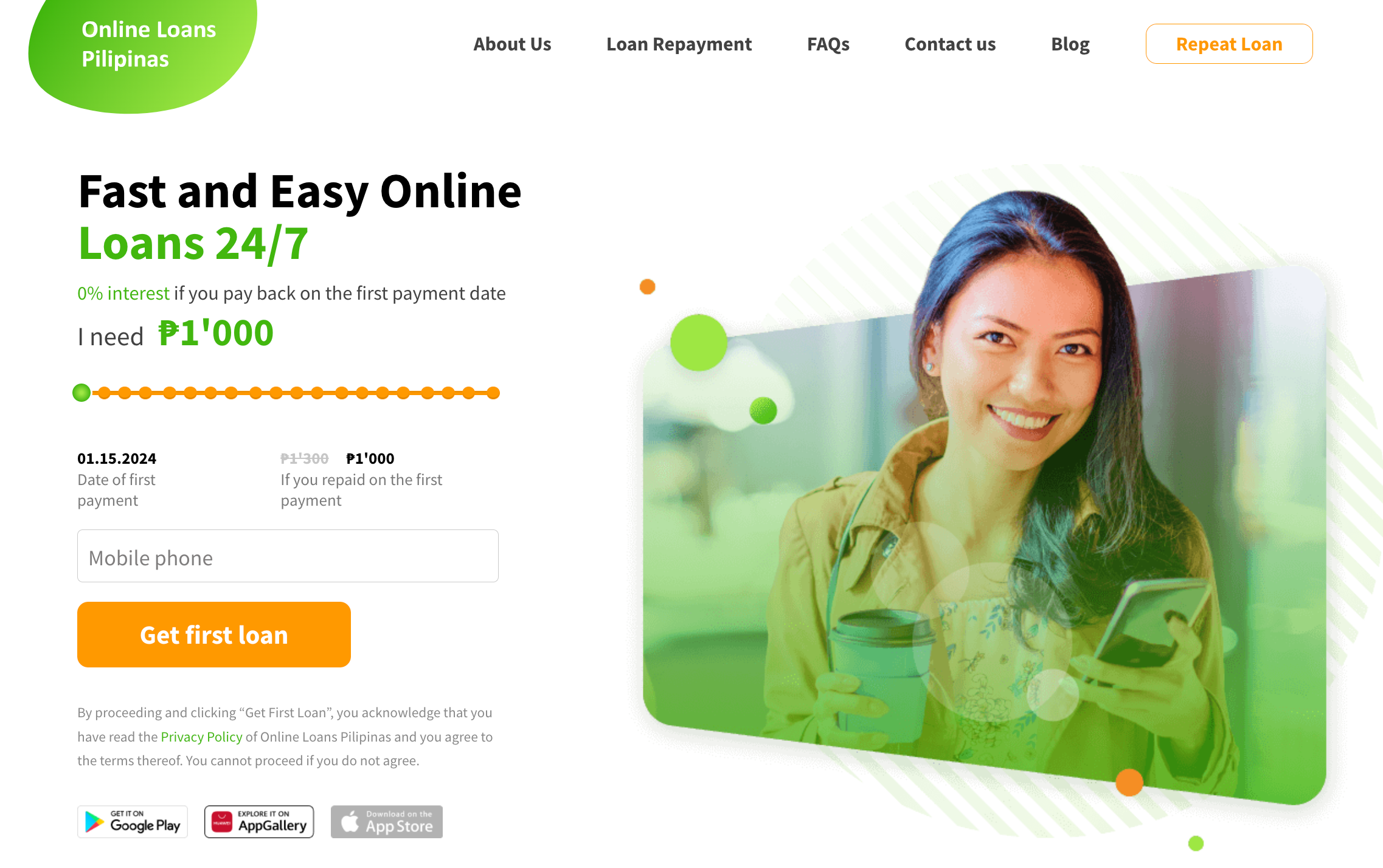

Online Loans Pilipinas (OLP) is an innovative financial service provider in the Philippines, offering a convenient and efficient way to access loans. As a digital-based platform, OLP loan app revolutionizes the traditional lending process by providing quick loan approvals and disbursements through its user-friendly website. This company stands out in the Philippine financial market for its commitment to providing accessible and hassle-free loan solutions to Filipinos.

Is OLP Legit?

When it comes to financial services, the legitimacy of the provider is a paramount concern. Online Loans Pilipinas operates with full legal compliance in the Philippines, adhering to all regulatory standards set by the governing financial authorities. The company is recognized for its transparent and ethical lending practices, ensuring that clients receive fair and secure loan services. With its strong regulatory compliance and positive customer feedback, OLP loan app has established itself as a trustworthy and reliable financial partner for many Filipinos.

Advantages when apply loan at Online Loans Pilipinas

Applying for a loan at Online Loans Pilipinas comes with several advantages:

- Speed and Convenience: OLP’s online application process is quick and easy, allowing clients to apply for loans from the comfort of their homes. Loan approvals are typically processed within minutes, making it ideal for urgent financial needs.

- Flexible Loan Amounts: Depending on the borrower’s eligibility, OLP offers a range of loan amounts, providing flexibility to meet various financial needs.

- No Collateral Required: OLP loans are unsecured, meaning borrowers do not need to provide collateral, making it more accessible for a larger segment of the population.

- Competitive Interest Rates: OLP offers competitive interest rates, ensuring borrowers are not overburdened financially.

- Transparent Terms and Conditions: The terms and conditions for loans are clearly outlined, ensuring borrowers fully understand their commitments.

Online Loans Pilipinas loans requirements

To apply for a loan at Online Loans Pilipinas, applicants must meet the following requirements:

- Must be a Filipino citizen or a resident of the Philippines

- Age between 22 to 60 years old

- A valid government-issued ID

- Proof of income, such as payslips or bank statements

- Active bank account for loan disbursement

The simplicity of these requirements underscores OLP app commitment to providing accessible financial solutions to Filipinos from various walks of life.

How to Apply for a Loan in Online Loans Pilipinas

To apply for a loan with Online Loans Pilipinas (OLP), follow these straightforward steps:

- Download the OLP mobile application from your app store.

- Open the application. Carefully review the notices, Terms and Conditions, and Privacy Policy, then select the ‘Accept’ option.

- From the app’s main screen, select your desired loan amount and tap on the ‘Apply’ button.

- Input your mobile phone number on the ensuing page and press the ‘Send Me Code’ button. Once you receive the One Time Password (OTP) on your phone, enter it in the designated field.

- Fill in all the required personal and financial details and proceed by clicking ‘Next’.

- On the following page, provide your province and complete address, then click ‘Next’.

- Upload a scan or photograph of a valid ID from the list of acceptable documents provided within the OLP app.

- Take and upload a selfie with the ID you have chosen for your application.

- Enter the details of your bank account or e-wallet where you wish to receive the loan amount, and finalize the process by clicking on ‘Get Money’.

Conclusion

Online Loans Pilipinas stands as a beacon of financial assistance in the Philippines, offering a blend of speed, convenience, flexibility, and reliability in its loan services. Whether it’s for emergency expenses, business ventures, or personal goals, OLP loan app provides a dependable financial avenue, empowering Filipinos with the resources they need to fulfill their financial objectives. With its user-friendly platform, straightforward requirements, and commitment to client satisfaction, Online Loans Pilipinas is redefining the landscape of personal financing in the Philippines.

On the partner site