Valley Loan App Review

«Valley Loan App» - Loan company summary:

Valley Loan App offers an online lending platform that caters to the needs of regular Filipino borrowers seeking convenient access to personal loans. These loans come with adaptable repayment terms, competitive interest rates, and a straightforward application procedure. Valley Loan is the ideal solution for individuals facing immediate financial requirements, such as emergency expenses, bills, or personal expenditures.

When utilizing Valley Loan APK, borrowers can count on a swift application process, punctual loan disbursements, and attentive customer service support. This guide provides a comprehensive overview of Valley Loan’s features, the application process, the various loan options available, and other vital information necessary for obtaining fast and trouble-free personal loans in the Philippines.

Valley Loan App is Legit

The credibility of the Valley Loan App can be confirmed by its ownership under Flash Cash 101 Lending Corp, which possesses SEC Registration No. CS201915317 and Certificate of Authorization No. 3083.

Valley Loan Apk Features

Comparing Loan Options:

Valley Loan Apk presents a range of online loan products that come with favorable interest rates, designed to cater to your needs. Our refund policy and fees are customer-friendly, ensuring your satisfaction at every stage of the process. It’s important to fully grasp the total loan cost, encompassing both interest and fees, as well as the repayment duration.

Utilizing Your Loan:

Once your application receives approval, Valley Loan will transfer the funds to your bank account through G-Cash, granting you the freedom to use the money for any purpose, whenever you need it!

Repaying Your Debt:

To maintain a positive financial standing, it’s essential to make timely monthly loan payments. Missing a payment may result in late fees and potential damage to your credit score.

Valley Loan Product Overview:

- Cash Loan Amount: ₱2,000.00 – ₱20,000.00

- Loan Duration: 91 days – 365 days

- Interest Rate: Maximum APR is 20%

- Annual Transaction Fee: 0

- Service Fee: Ranges from 0.1% to 0.35%

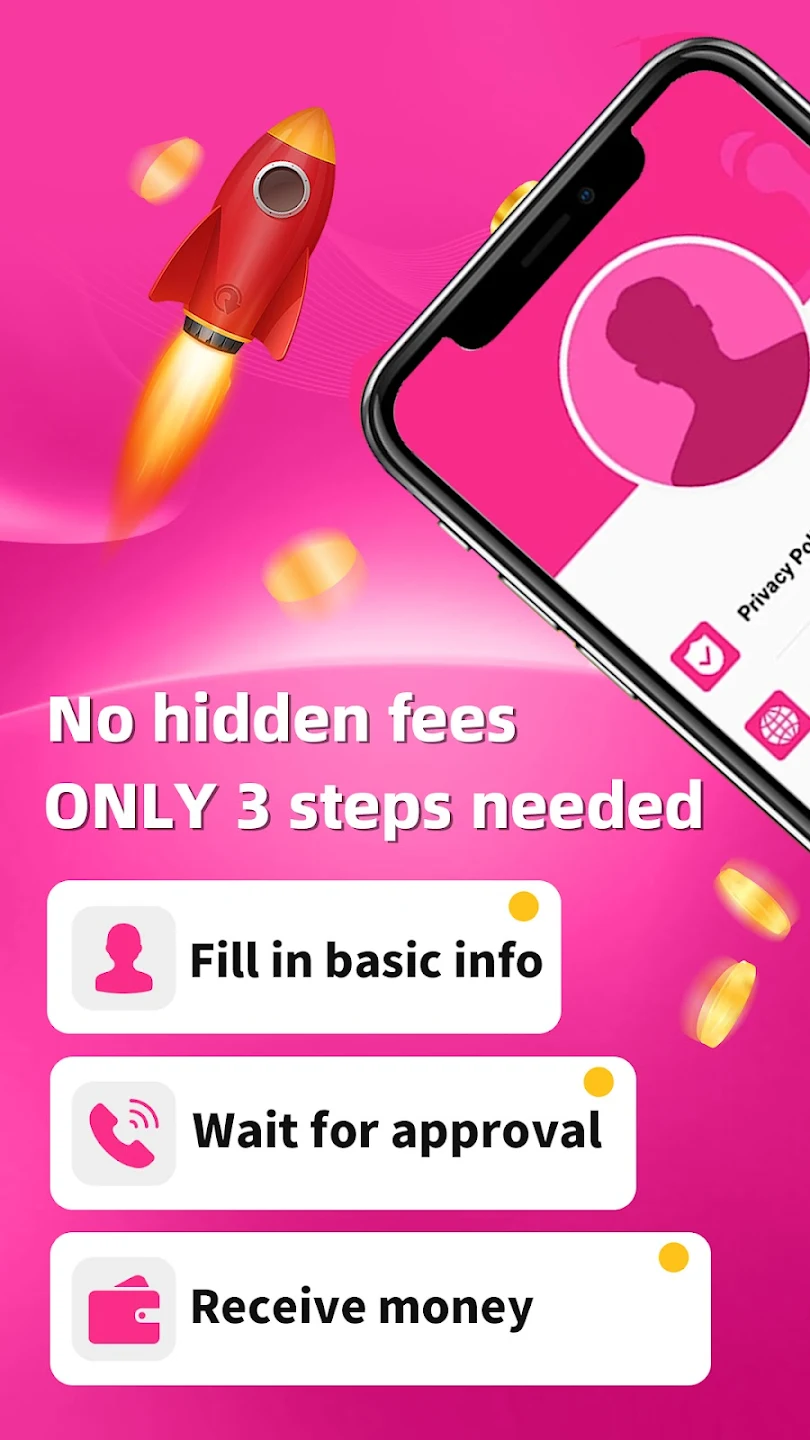

The Application Process for Valley Loan

Applying for an online loan via the application is a straightforward process. Just follow these steps:

Step 1: Download and Create an Account

- Download the Valley Loan APK/IOS.

- Register an account by entering the OTP code within the application.

Step 2: Choose the Loan Amount and Term on the app interface.

Step 3: Complete the Personal Information and Identity Verification:

- Provide personal details such as your full name, date of birth, address, and email.

- Upload images of both sides of your national ID card and a portrait photo.

- Share information about your employment and salary.

Step 4: Once you’ve submitted your application, Valley Loan will review it and promptly inform you of the outcome. If your loan is approved, the funds will be disbursed to your account.

Note: The loan limit granted by Valley Loan will be determined by the information you supply, so ensure that all details are accurate and complete.

Requirements for Loan Application

To be eligible for an online loan application at Valley Loan, you should ensure that you meet these fundamental criteria:

- Possession of a Philippine national ID card.

- Owning a bank account, with any bank being acceptable.

- Access to a smartphone and the provision of a valid phone number for registration.

- Age within the range of 18 to 65 years to qualify for a loan.

- Demonstrable stable employment and the capacity to repay the borrowed amount.

These prerequisites constitute the foundational requirements, and we trust that you can fulfill them before proceeding with your online loan application with Valley loan app.

Tips for a Success Application

To ensure a successful loan application and prompt disbursement at Valley Loan App, consider these helpful tips:

- Accurately and comprehensively provide your personal information.

- For your initial loan application within the app, opt for a reasonable loan amount, avoiding excessive requests.

- Ensure the clarity, validity, and authenticity of the information and images on your national ID card.

- Including income statement images can significantly enhance your approval prospects.

- Maintain a clean credit history by settling all outstanding debts with other applications, achieving a flawless success rate.

- Stay informed by regularly reviewing the app’s policies and terms and conditions.

Conclusion

Valley Loan App stands as an online lending platform, dedicated to delivering hassle-free, secure, and swift cash loans to everyday borrowers throughout the Philippines. Be it for unforeseen emergencies or sudden expenses, Valley Loan PH is your reliable partner. Offering an extensive array of loan options, adaptable repayment terms, competitive interest rates, punctual disbursements, and top-notch customer service, ValleyLoan remains the favored choice for numerous borrowers across the Philippines.

Therefore, if you seek prompt cash without the accompanying hassle or inconvenience, don’t hesitate to submit your loan application with Valley Loan App today.

On the partner site

Best MFOs

29.01.24 23:38

Got a quick loan for a spontaneous trip. Amazingly fast service!

23.12.23 11:18

Very pleased with the efficiency of the service. I received a loan instantly, and customer support was top notch. Thank you for your help!

30.03.24 0:01

Simple and fast.